|

|

|

|---|

|

|

|

|---|---|---|

|

|

|

|

|

|

|---|---|---|

|

|

|

|

Understanding Life After Filing Chapter 7 Bankruptcy: A Complete Beginner’s Guide

What Happens Immediately After Discharge?

After your Chapter 7 bankruptcy is discharged, you'll find a new financial landscape awaiting you. It's essential to understand the changes to your credit and financial obligations.

Immediate Effects

The discharge of your debts means you are no longer legally required to pay them. However, some debts may not be discharged, such as student loans and certain taxes.

- Credit Score Impact: Your credit score will have been significantly impacted, and rebuilding it should become a priority.

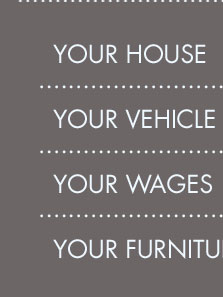

- Retention of Assets: You may retain some assets depending on the state exemptions applied during your bankruptcy process.

Steps to Rebuild Your Credit

- Obtain a secured credit card to start rebuilding your credit.

- Make all your future payments on time to avoid further credit damage.

- Regularly check your credit reports for accuracy.

Rebuilding Your Financial Life

Reestablishing your financial standing is crucial after a Chapter 7 bankruptcy. The process involves disciplined planning and strategic actions.

Creating a New Budget

Establishing a realistic and sustainable budget is the cornerstone of rebuilding your finances. Focus on essential expenses and debt repayment.

Seeking Professional Guidance

Consider consulting a financial advisor or a bankruptcy law firm in Minnesota to guide you through the recovery process and help you avoid future pitfalls.

Long-term Considerations

While the immediate aftermath of a Chapter 7 discharge might be daunting, focusing on long-term financial health is critical.

Setting Financial Goals

Set realistic short-term and long-term financial goals to motivate yourself and track your progress over time.

Understanding Legal Obligations

Even after a discharge, it's crucial to stay informed about any legal obligations you might still have. If you're unsure, consulting a professional is advisable.

FAQs About Life After Chapter 7 Bankruptcy

How long does Chapter 7 bankruptcy stay on my credit report?

A Chapter 7 bankruptcy can stay on your credit report for up to 10 years from the date of filing.

Can I keep my home after filing Chapter 7 bankruptcy?

It depends on your specific circumstances, including state exemptions and mortgage status. Consulting a bankruptcy in CT Chapter 7 expert can provide clarity.

Is it possible to get credit after Chapter 7 bankruptcy?

Yes, while it may be challenging initially, obtaining a secured credit card or a credit-builder loan are viable options to start reestablishing credit.

After filing you will be deluged with offers for credit cards and car loans. Predatory companies want to loan you money at high rates right ...

Almost all banking continues normally upon filing. Your checks get deposited normally, you get to spend your money normally. And your debit ...

What Happens Right After You File Chapter 7 Bankruptcy? - You get immediate protection from creditors and debt collectors. This is thanks to the ...

![]()